401k rmd tables

FAQs on Required Minimum Distributions. The Required Minimum Distribution shortly known as RMD is the minimum amount a retiree needs to withdraw from their account every year after they reach 72.

After Death Required Minimum Distribution Rules After The Secure Act Dbs

However the first payment can be delayed until April.

. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. Build Your Future With a Firm that has 85 Years of Retirement Experience. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Determine beneficiarys age at year-end following year of owners. Line 1 divided by number entered on line 2. RMDs are a way for the.

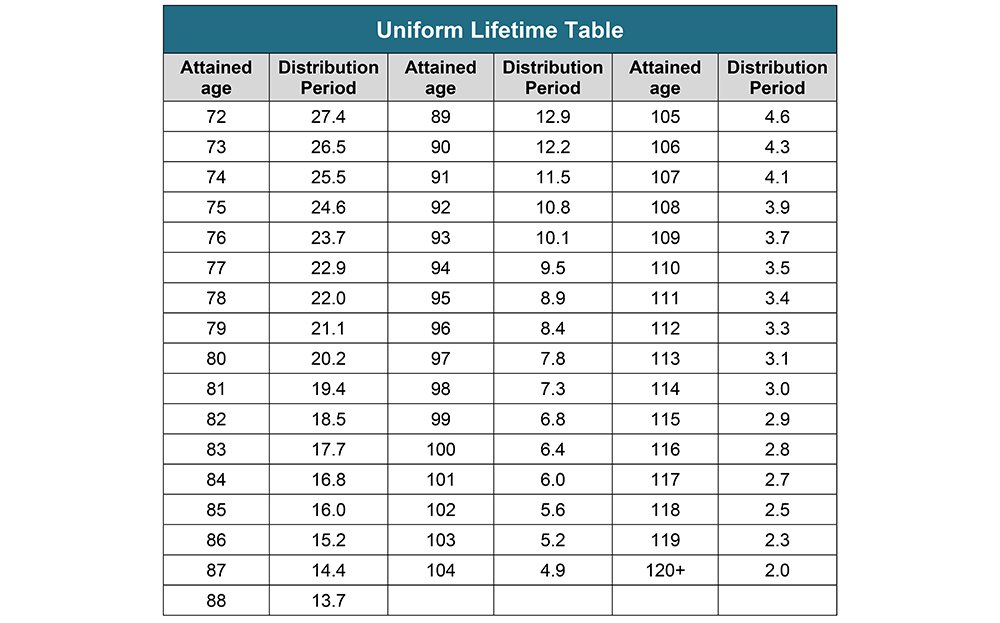

Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year. Distribution period from the table below for your age on your birthday this year. Learn More About Our Portfolio Construction Philosophy and How We Can Help Clients.

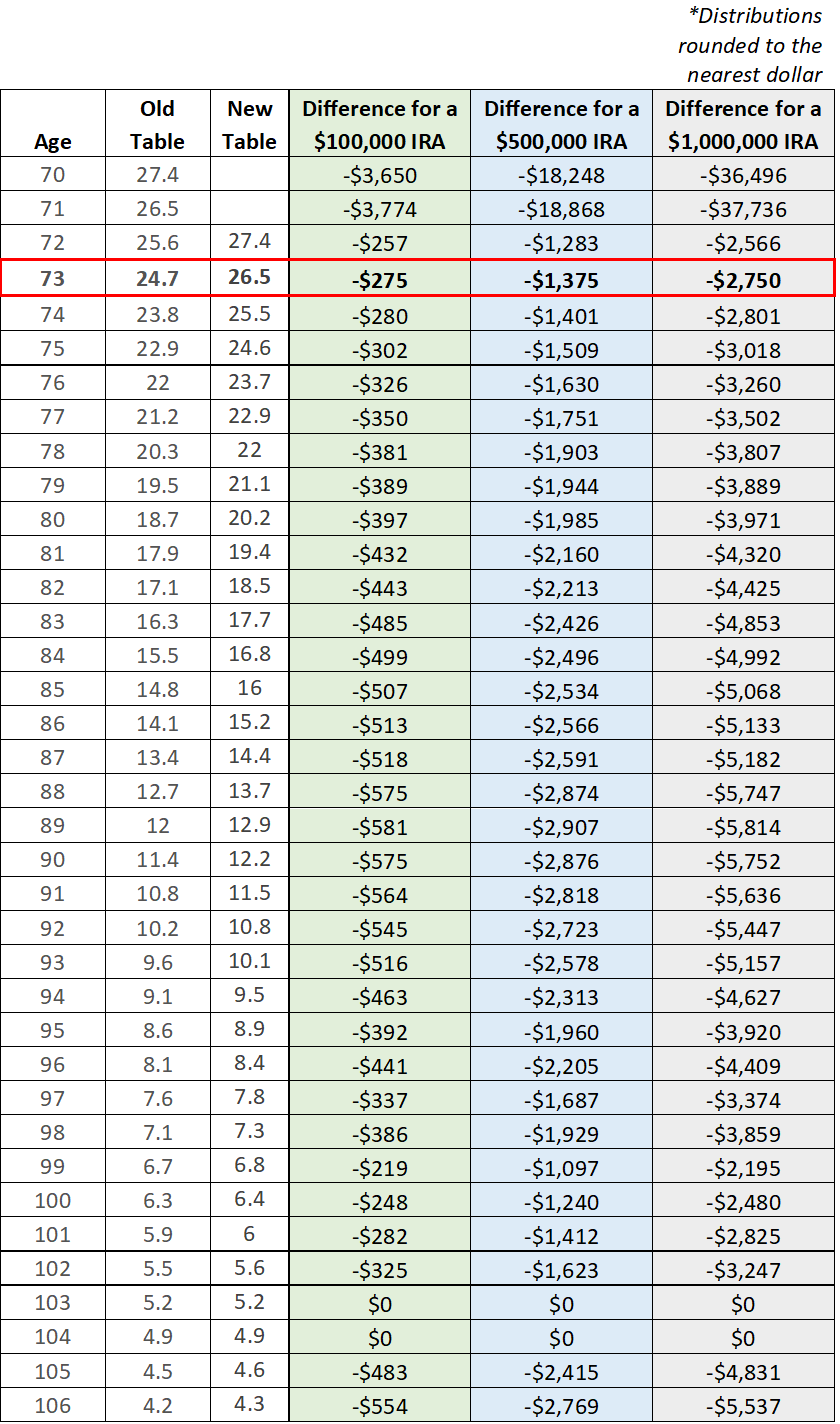

You must take your first required minimum distribution for the year in which you turn age 72 70 ½ if you reach 70 ½ before January 1 2020. Ad Use This Calculator to Determine Your Required Minimum Distribution. A factor of 274 at age 72 means that out of a 1 million total balance in the pre-tax retirement accounts as of December 31 of the.

Learn How We Can Help. To calculate your RMD look up the distribution period for age 74 which is 255. The first will still have to be taken by April 1.

Thats the RMD amount that you will. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. RMDs from 401k plans and 403b plans as well as other profit-sharing and defined contribution plans can be deferred until you actually retire.

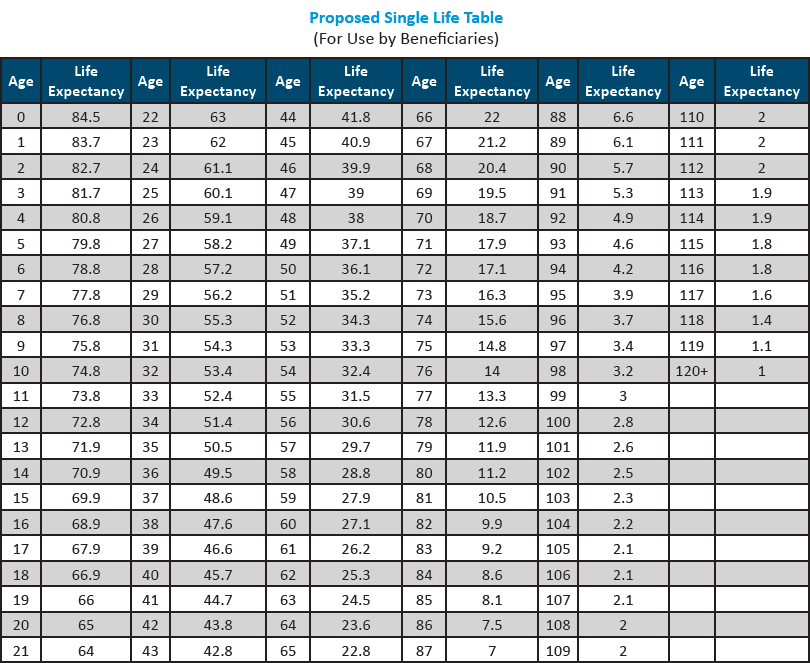

Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Distribute using Table I.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Ad Strong Retirement Benefits Help You Attract Retain Talent. Distribution period from the table Table III for your age on your birthday this.

Divide 500000 by 255 to get your 2022 RMD of 19608. Chart of required minimum distribution options for inherited IRAs beneficiaries Publication 590-B Distributions from Individual. A required minimum distribution or RMD is an amount the IRS requires taxpayers to withdraw from their pre-tax retirement accounts once they reach 72.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. 9 rows Review a required minimum distribution table that compares IRAs and defined. Ad You Can Roll Over Your Old 401k into a TD Ameritrade IRA in 3 Simple Steps.

This is your required minimum distribution for this year. Ad If you have a 500000 portfolio download your free copy of this guide now. To calculate your required minimum distribution simply divide the year-end value of your IRA or retirement account by the distribution period value that matches your age on.

Ad Objective-Based Portfolio Construction is Key in Uncertain Times. Uniform Life Table Effective 112022. This is your required minimum distribution.

The second by December 31. Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home. Ad We Can Help You Invest For Goals Like Retirement College Or A Vacation Home.

Investments Include Mutual Funds College Savings Plans Personalized Portfolios More. 401k rmd tables Senin 12 September 2022 Edit. This means you must use the.

Rmd Table Rules Requirements By Account Type

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

How Required Minimum Distributions Work Merriman

Rmd Table Rules Requirements By Account Type

What Is A Required Minimum Distribution Taylor Hoffman

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Is There New Required Minimum Rmd Tables For 2022 Michael Ryan Money Financial Coach

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Your Search For The New Life Expectancy Tables Is Over Ascensus

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Strategies To Reduce Or Delay Rmd Mandatory Withdrawals Required Minimum Distribution Content Strategy Strategies

Your Search For The New Life Expectancy Tables Is Over Ascensus

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

What Is A Required Minimum Distribution Taylor Hoffman

Where Are Those New Rmd Tables For 2022

Required Minimum Distributions Have Resumed For 2021 Henssler Financial